1st Quarter 2023 Update

summary

Up. Down. Up.

That was the story for stocks and bonds during the first three months of the year. Strong January. Weak February. Strong March.

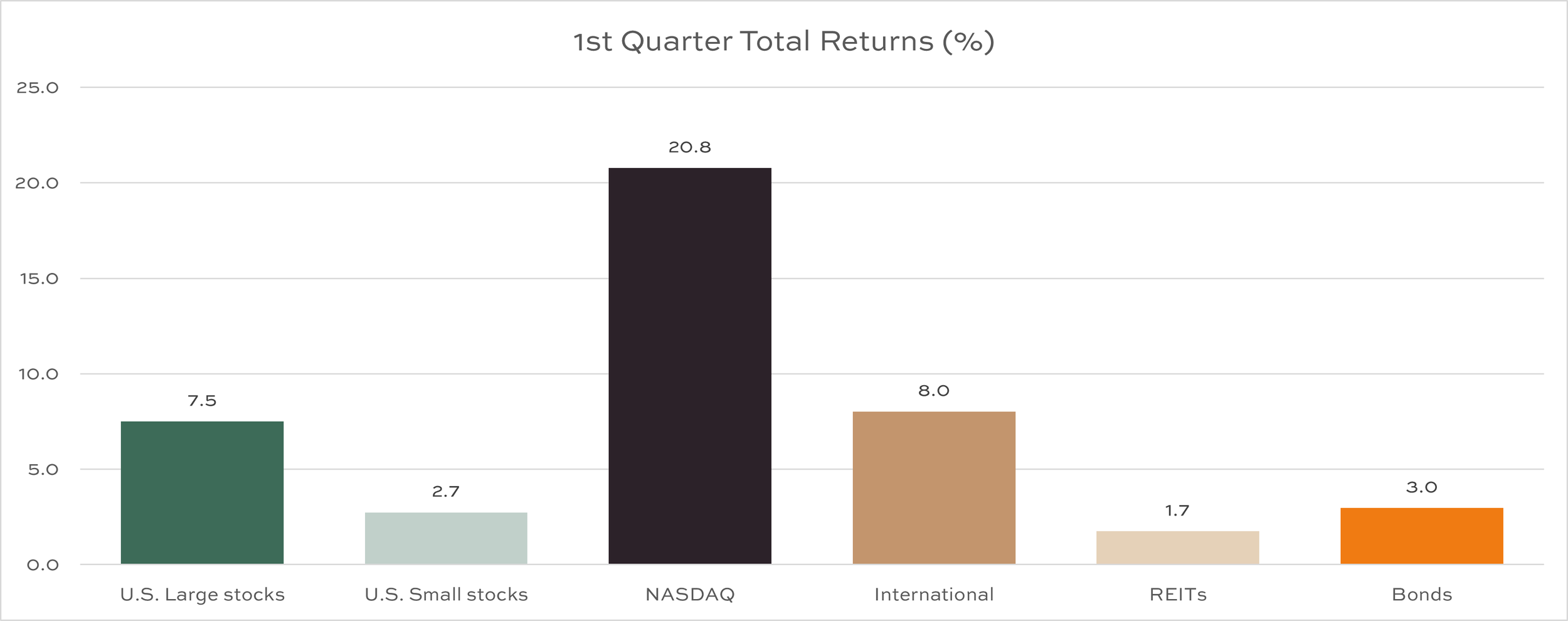

For the quarter, U.S. large and small stocks returned 7% and 2.5%, respectively. International stocks were up over 8%. Bonds, rebounding from their worst since at least 1980, returned about 3%.

Markets had their own version of March Madness. The biggest news came from banking, with two prominent failures in Silicon Valley Bank and Signature Bank. Thus far, they seem to be isolated events and not part of a bigger banking crisis. Commercial real estate loans, which primarily impact regional banks, are worth watching as large amounts of that debt needs to be refinanced at higher rates and lower values in 2023.

Before Silicon Valley Bank became a household name, the Federal Reserve (Fed) seemed intent to continue raising interest rates to combat stubbornly high inflation. The market is now expecting the Fed to reverse course and cut rates before the end of the year, which helped to push stocks higher in March. If banking concerns continue to fade, all eyes will refocus on inflation data and what that means for the likely path of interest rates.

Cash alternatives have been very popular, as yields on these savings are often 4% or better. Money market funds saw huge inflows during the quarter. Assets in these funds have grown by $377 billion since mid-February.

In late December, Congress passed a bill that included the Secure Act 2.0, which included a number of interesting planning opportunities and updates for retirement savers. Two of the most popular concepts have been the introduction of 529-to-Roth IRA conversions and adjustments to rules around required minimum distributions (RMDs).

first quarter review

Diversified investors have been enjoying 2023 much better than 2022, when rising interest rates punished most major asset classes. In fact, using Vanguard’s Balanced Fund as a proxy - which is essentially 60% stocks and 40% bonds - this is the fourth best start to the year since 2001! The green line is 2023 in the chart below, and all other years are represent by the brown lines.

Growth rebounds: The NASDAQ 100 index, primarily made up of technology and other growth-oriented stocks, made headlines by entering a new bull market toward the end of March. The index is up about 25% from last December’s lows. That may be little consolation for long-term owners, who are still more than 20% below the January 2022 peak. In 2022, growth stocks generally experienced the largest losses from higher interest rates.

Dividend growth stocks outperform high dividend payers. Ultra-low interest rates of the 2010s encouraged some investors to take more risk. Dividend-paying stocks were often benefactors, either those companies who already pay high dividend yields or those that have a strong history of growing dividends over time. Both strategies have been successful in the past; however, the performance of this group of companies was muted in the quarter. Higher interest rates may have lured some savers back to fixed income, and new expectations for rate cuts from the Fed boosted growth companies more than dividend-oriented businesses.

Banks were the story: When asked why predictions are hard to make, I give you 2023’s response – banks. Coming into 2023, I don’t recall anyone ringing alarm bells over the health of our banking system. And yet, that’s all we have talked about in recent weeks. Come to find out, all the fiscal stimulus that entered the economy in 2020 and 2021 had to go somewhere, and plenty found its way to banks in the form of uninsured deposits. Banks, in turn, had to do something with all the new capital. U.S. Treasury securities, typically considered the “risk-free” asset, reminded investors that they may be insulated from credit risk, but they could have plenty of interest rate risk. Silicon Valley Bank’s failure sparked concerns over both bank health and safety of deposits.

Cash floods out of banks: savers pulled billions of dollars away from banks, opting instead for money market funds and other cash alternatives. Money market fund assets ballooned by over $375 billion since mid-February. Two years ago, yields on 1-year U.S. Treasuries were an abysmal 0.07%. Today, that same Treasury yields about 4.6%.

NOTE: please contact the Divvi team if you are interested in exploring our cash management services, money market funds, or other options for excess cash.

Fed pivot? Markets think so. We are not so sure. Late last year, outgoing President of the Kansas City Federal Reserve Esther George spoke about fighting the inflation battle. Her view was the Fed needed to influence inflation while they still could by slowing demand. Taking liquidity out of the system by raising interest rates and reducing the size of their balance sheet would be necessary to avoid a repeat of the 1970s style inflation, an outcome they want to avoid.

Looking forward

RECESSION INEVITABLE? Many economists still expect a recession in the back half of 2023. Even if we do slip into a recession in the coming months, remember that markets are forward-looking. They anticipate. And they represent the consensus expectations from all investors. If investors are thinking about selling stocks in advance of the recession, they may be too late.

INFLATION: Inflation has remained stubbornly high, at roughly 6% year-over-year, as of February’s data release. The data for the Midwest region is only slightly lower, at 5.6%. Food prices have been a big driver of higher prices, as has housing. Prices of new homes have been falling in recent months though, as buyers’ budgets adjust to higher mortgage rates.