August’s Rough Start: A Few Thoughts

The stock market got off to a rough start in August, at least for most investors. At the beginning of the month, reported jobs numbers came in weaker than expected. Stories about a yen carry trade unraveling added fuel to the fire. Investors quickly asked questions like…

Is the Fed too late in cutting rates?

Is a recession now unavoidable?

Are stocks going to head a lot lower?

From August 1st through the 5th, the S&P 500 fell about 6%. The NASDAQ was down more, by about 8%. Small cap stocks fell by about 10%.

The VIX, otherwise known as the “fear gauge,” is one measure of expected stock market volatility. When investors think volatility will rise, the VIX moves higher. Conversely, the VIX is typically low or declining when investors expect calmer markets. During those first five days of August, the VIX spiked from 16.4 to 38.6, or a 136% jump. The VIX had not closed that high since October 2020.

If you are interested in reading more on the week that was, here are two brief recaps from CNBC and MarketWatch:

It can be easy to let emotion take over in times like this. That is something we prefer to avoid.

The growing field of behavioral finance can help us understand how different events are likely to make us react. For example, the pain we experience from losses is typically much more powerful than the pleasure we get from equal-sized gains. Our brains are not wired to make us good investors.

There is so much we do not control when it comes to investing. We do not control day-to-day market returns. We do not control changes in consumer prices (i.e., inflation). We do not know where interest rates will be a year from now.

But we can try to control our behavior. Here are a few things that can potentially help.

Plan first. Then invest.

We believe investing is made easier by starting with the plan. How will the money be used, and when? There is no point in creating a long-term investment plan if the assets are intended to support spending goals 12 months from now.

As cliche as it may sound, understanding and prioritizing an individual’s goals - things like retirement, education, a vacation home, emergency savings, etc. - are so important when trying to determine how much and what type of risks make sense in different situations. Imagine reversing the order of operations here. We are sometimes asked, “What would you invest in if you had $10,000 today?” It’s a perfectly reasonable question. Our response is, “It depends.” It always leaves people unsatisfied. But it’s the truth.Have a written investment plan.

This is what we call the Investment Policy Statement. And it is, in my opinion, the single most important document we can create with clients to help guide decision making. It outlines important parts of the strategy like time horizon, the mix between stocks, bonds, and other investments, and how the portfolio will be managed on a day-to-day basis. And it should evolve over time, just as we do.Be aware of history.

Look at the first chart below from JP Morgan. The gray bars illustrate annual returns for the S&P 500 since 1980. The red dots show that stocks experienced meaningful declines nearly every year. A 6% drawdown like the one we experienced at the beginning of August seems normal.

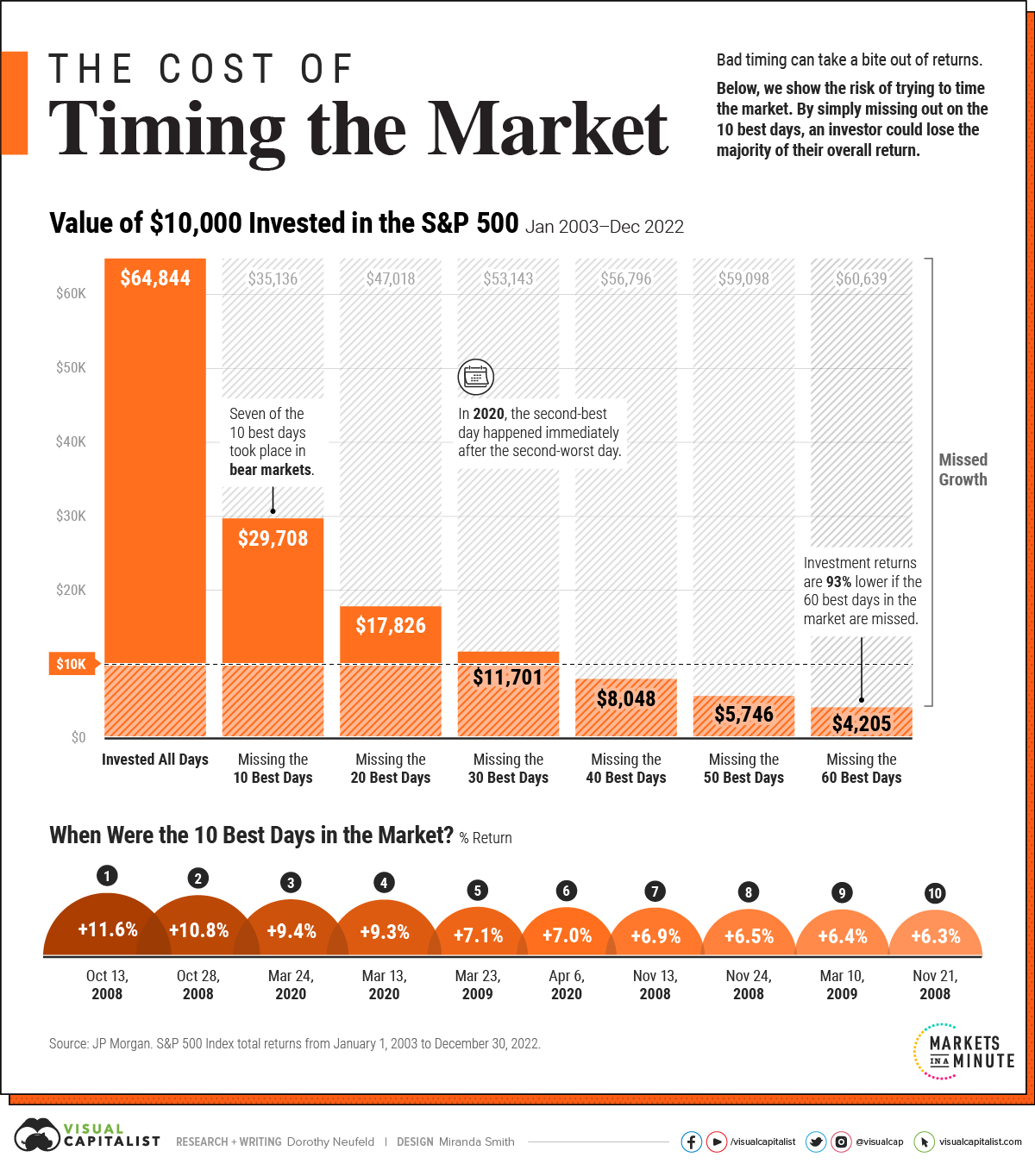

Furthermore, market volatility tends to cluster. The biggest down days generally happen alongside the biggest up days. New, unexpected information is being digested by investors. Disagreements are aired publicly, via buying and selling, and volatility ensues.

Now look at the second image from Visual Capitalist. To be honest, this is usually one of my least favorite charts shared by people in my field. But in this case, I thought I would make an exception. Why? Because for those who are already invested, it can be so tempting to sell, wanting to cut losses, when markets are falling. Fear is a powerful emotion. And the potential impact can be big.